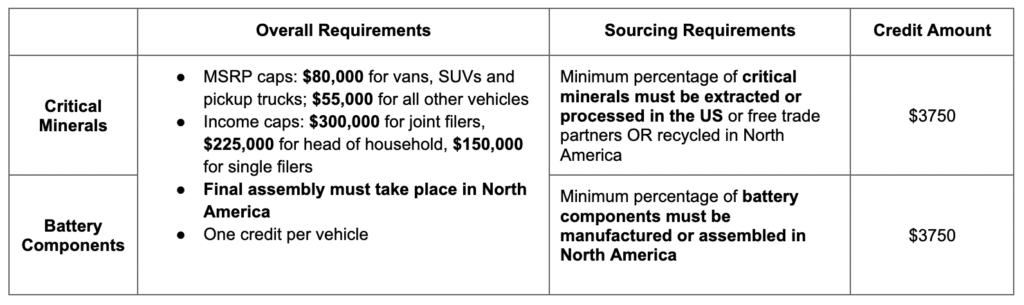

Tax Credit For Hybrid Cars 2024 – The federal tax credit rules for electric vehicles often change, as they did on January 1, 2024. The good news is the tax credit is now easier to access. The bad news is fewer vehicles now qualify for . The IRS recently announced updates to its $7,500 tax credit for electric vehicle owners. The changes reduce the number of electric and hybrid vehicles that qualify for the tax credit to 13, which is .

Tax Credit For Hybrid Cars 2024

Source : www.npr.orgHow Do the Used and Commercial Clean Vehicle Tax Credits Work

Source : blinkcharging.comThe $7,500 tax credit for electric cars is about to change yet

Source : www.npr.orgElectric Vehicles: EV Taxes by State: Details & Analysis

Source : taxfoundation.orgEV Tax Credits: Here’s every electric car or plug in hybrid that

Guide to Plug In Hybrid Tax Credits

Source : www.caranddriver.comThe 7 Fully Electric Cars That Now Get $7,500 US EV Tax Credit

Source : cleantechnica.com2022 EV Tax Credits from Inflation Reduction Act Plug In America

Source : pluginamerica.orgHow The Federal Electric Vehicle (EV) Tax Credit Works | EVAdoption

Source : evadoption.comEV Tax Credit 2024: How It Works, What Qualifies NerdWallet

Source : www.nerdwallet.comTax Credit For Hybrid Cars 2024 The $7,500 EV tax credit will see big changes in 2024. What to : The tax rules for electric vehicles are changing. Expert: “Buyers will need to satisfy more conditions than in previous years.” . Back in the distant past (just two months ago), we wrote a story outlining how few electric vehicles qualified for the full $7,500 federal tax credit for electric vehicles and plug-in hybrids. At the .

]]>